This post may contain affiliate links. If you use these links to buy something we may earn a commission at no extra cost to you. Thank you for your support!

If you’ve been scrolling through your Instagram feed recently, you might have noticed a shiny new Repost button under your favorite posts and reels. This Instagram Repost feature is one of the most exciting new Instagram features of 2025 — and it’s already making how Instagram users connect waaay easier to share and discover!

In this guide, we’ll explain exactly how the Instagram Repost feature works, the best ways for you to use it to grow your online presence, followers and collaborations, or simply to share the posts you think are funny. We will also talk about how to stay mindful of privacy concerns and etiquette.

You can be reposting a friend’s Instagram post, a public reel from a celebrity, or a client’s brand announcement, regardless of whatever you are reposting, there is endless potential for greater reach!

What Is the Instagram Repost Feature?

The Instagram Repost feature allows you to conveniently reshare someone else’s Instagram post or reel directly to your followers’ feeds – without having to take a screenshot of the post or using a reposting app from the App Store.

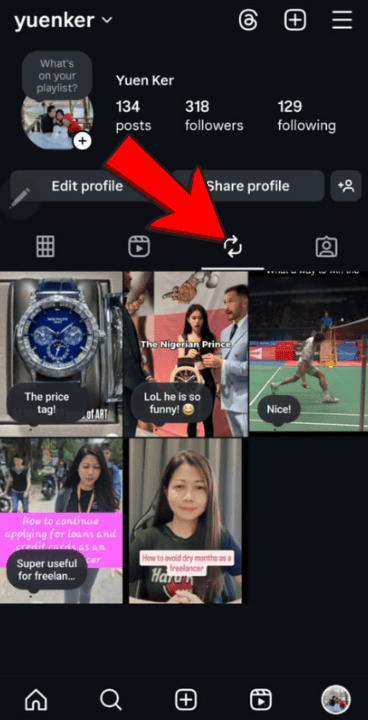

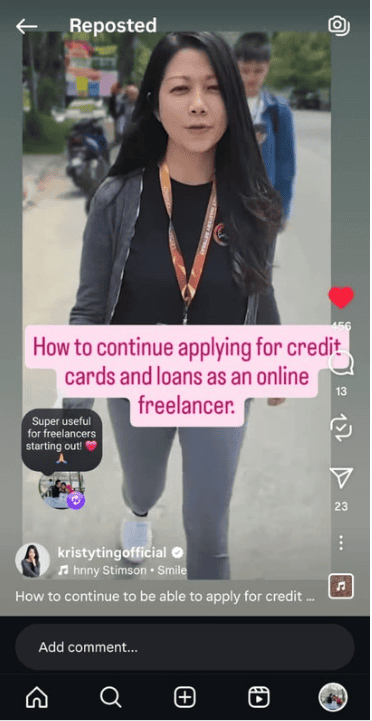

Not to worry though, when you repost content, it will not appear on the nine-dot icon feed, also known as the ‘grid’ view of your profile. The content that you repost will appear in a separate tab on your profile called “Reposts.” This keeps your own post and reposted content super organized, so your followers can easily browse both your regular posts and the things you’ve shared from others.

Why Instagram Added the Repost Button

Instagram brainstormed this native feature to make sharing people’s posts so much easier and more seamless. Before this, most Instagram accounts shared only via:

- Instagram Stories (temporary, disappears after 24 hours)

- Direct messages (private sharing only)

- Screenshot method (low-quality and time-consuming)

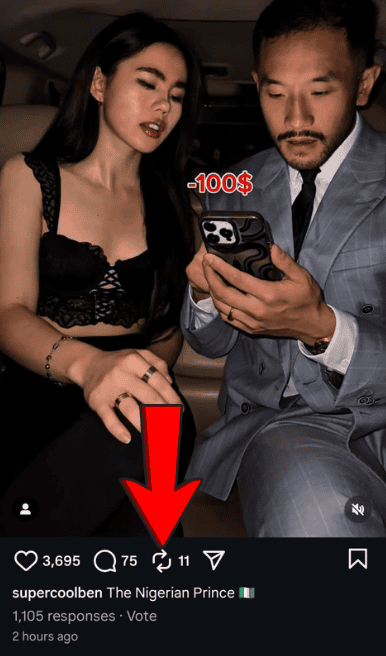

The Instagram Repost feature is so exciting because now, the repost button really means that you can share social media posts from other public accounts into your own feed with just a tap – keeping the original caption and credit to the original creator intact, whilst adding your own thoughts or opinion on it in a rather cute floating bubble!

It’s in fact another great way for all these content creators and brands to tap into new audiences when they collaborate, especially when Instagram work is part of a larger marketing strategy to them across multiple social media platforms. This feature definitely will be a great way to grow audiences and eventually followers!

💡 Related reading: How to Create Content That Connects with Your Audience

How to Repost on Instagram: Step-by-Step

Here’s your quick guide to reposting on Instagram from your mobile device:

Step 1: Open Instagram and Find the Post

The first step is to open Instagram and scroll your Instagram feed, the friends tab, or explore the Instagram map to find a new post you want to share.

Step 2: Tap the Repost Icon

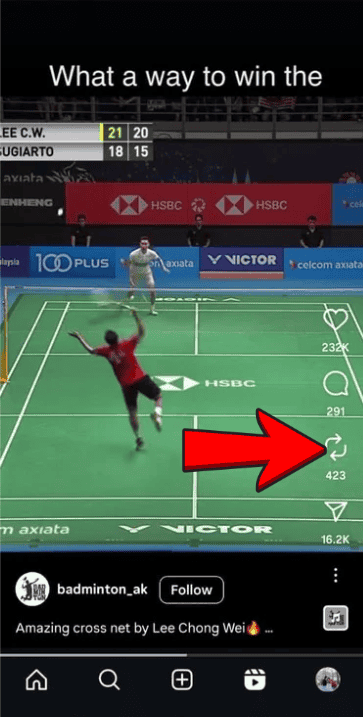

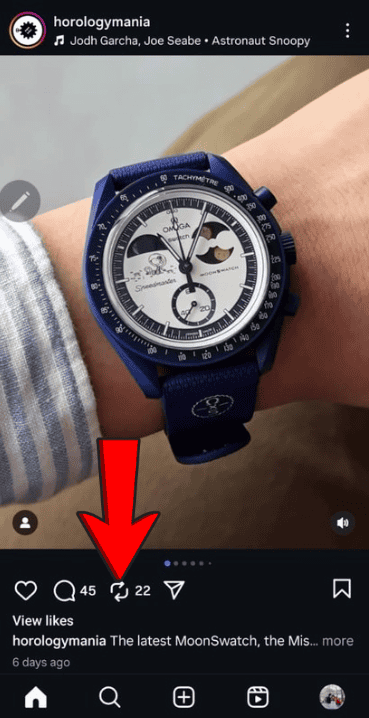

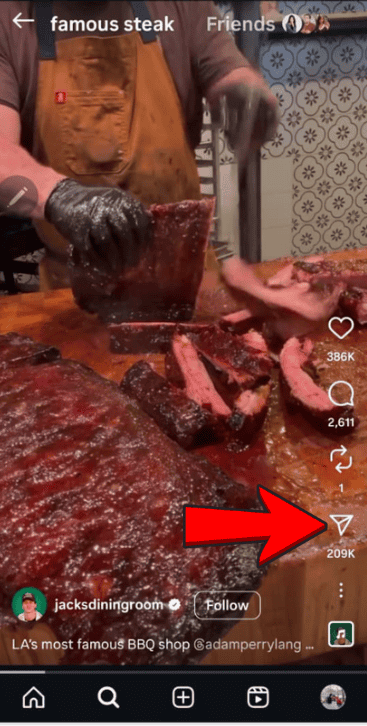

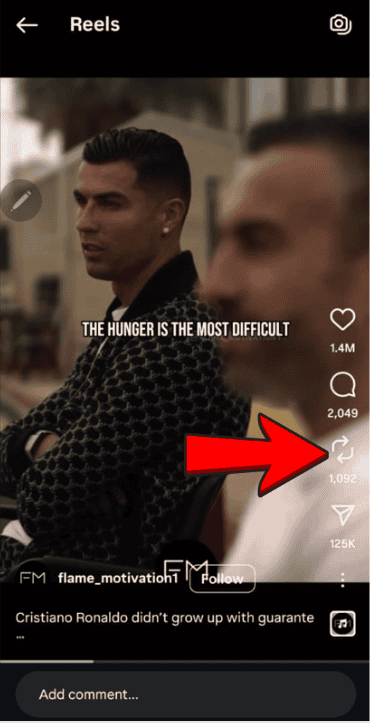

Under the post, next to the like and comment icons, you’ll see the repost icon. Tap it to start the process.

Step 3: Add Your Thoughts (Optional)

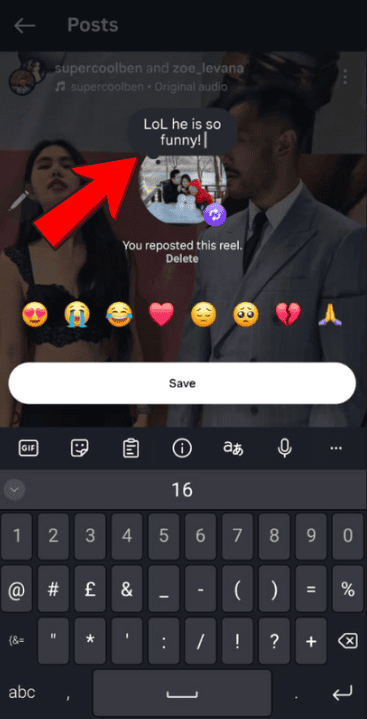

You can keep the original caption or add your own. This is a nice way to give context, tag friends, or explain why you’re sharing the repost Instagram content.

Step 4: Share to Your Followers’ Feeds

Tap the ‘Save’ button which is actually the share icon to confirm. The post will now appear in your own feed posts under the new Reposts tab, visible to your followers, separate from your 9-dot grid feed.

Reposting to Instagram Stories

If you want to share something the old way, ie temporarily, you can reshare to your Instagram Story instead:

- Tap the paper airplane icon under the post.

- Choose “Add post to your story”.

- Customize with stickers, text, or GIFs.

- Post to your own story.

This creates a reposted story that disappears after 24 hours, perfect for quick updates or casual shares.

Best Practices for Reposting

Here are the best ways to make the most of this new way to share:

- Always give credit – The repost feature automatically tags the original creator, but mentioning them in your caption is good practice, though optional.

- Respect privacy – You can only repost from public accounts unless you have permission from private accounts.

- Add value – Share why you’re reposting or what your followers can gain from it.

- Balance your feed – Mix own content with reposts to keep your feed fresh.

💡 Related reading: Top Tips for Growing Your Instagram Engagement

Where Reposts Appear

When you repost:

- It appears in your followers’ feeds

- It’s stored in your Reposts tab, separate from regular posts (as seen in the photos above)

- It shows the profile pictures and usernames of the original photographer or creator

This makes it easy for followers to click through to the original post and follow that account – see how this will work well for collaborations too? hehe

Privacy and Control Over Reposts

Yes, your posts now have that unlimited potential for new-found fame through viralized reposts – Yet not everyone wants their posts shared, some people are just all about privacy control. Instagram has thought about that and has given us such control through:

- Privacy settings – You can disable reposts for your content.

- Privacy policy – Instagram outlines how reposting works and how to manage your content visibility.

- Help center – If someone shares your post and you’re uncomfortable, you can request removal.

💡 Related reading: How to Protect Your Privacy on Social Media

How the Instagram Repost Feature Helps Creators and Businesses

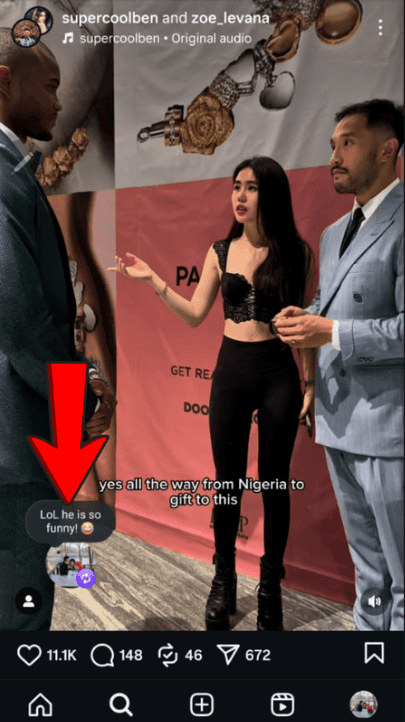

For all those content creators, social media managers and businesses out there, this Instagram repost button represents the ultimate collaborative function and is by now probably viewed as the one greatest feature addition they could ever dream of receiving from Instagram! Just through a simple repost click, celebrities and businesses can:

- Share user-generated content and social proof of what you are doing, or even to endorse someone!

- Turn their happy customers into new brand ambassadors

- Fill your feed with new content periodically without having to rely on constant photoshoots

- Reach new audiences when other Instagram users share their posts

Example: A restaurant posts a super succulent and delicious steak reel. Ronaldo (the footballer with 668M followers!), having had it before, chances upon the reel and reposts it, tagging the restaurant. His massive legion of followers see it, and Boom, the restaurant becomes an instant worldwide sensation, gaining fame, an explosion of followers and the hardest place to get a table reservation for months to come!

💡 Related reading: How to Build Social Proof for Your Business

Longevity: Comparing Reposts to Other Sharing Methods

Before this new explosive native feature was introduced, Instagram users postings were so annoyingly limited (haha), mostly shared via:

- Instagram Stories – Temporary, disappears in 24 hours 🙁

- Screenshot of the post – Saved to your camera roll and re-uploaded (low quality argh)

- Direct messages – Private sharing only, OMG

But now, this new reposting method has changed the entire landscape of Instagram post longevity – social media managers will love it especially because it is a very simple way to keep their social media posts alive waaaaaaaay longer while preserving the quality of the original content shared over and over again!

Tips for Making Your Posts More Repostable

If you want others to share your posts, here are a couple of ways to boost repost potential:

- Use Instagram Reels for higher visibility

- Keep your account public for maximum reach

- Post eye-catching new content with a clear type of content

- Write a compelling original caption that sparks emotion

- Engage with your followers so they feel connected to your own post

Final Thoughts

The Instagram Repost feature is one of the most exciting new Instagram features in years at the REVOLUTIONARY level! It’s a new way to connect, share, and discover with gargantuous potential – while giving credit where it’s due. The Repost feature is definitely the best ways for you to use it to grow your online presence, followers and collaborations, or simply to share the posts you think are funny from a friend’s tab update, an influencer or celebrity’s public reel, or your client or business owner’s announcement!

Just remember: mix your own feed posts with reposts to add variety to your feed, and use the reposts function to help you reduce the need for you to hack your brain in the search for new content to post every few days based on your calendar. Follow best practices, and respect privacy settings – That’s how you’ll keep your feed engaging, respectful, and fun. Haha, now go out there and start reposting!!

💡 Related reading: How to Create a Social Media Strategy That Works