This post may contain affiliate links. If you use these links to buy something we may earn a commission at no extra cost to you. Thank you for your support!

In a crowded market, it can be hard for life insurance agents to find new, high-quality leads that are ready for financial planning.

(Do not worry—you are not the only one who has trouble getting leads!)

The problem is that you may have:

- World-class work ethic

- Impeccable knowledge of life insurance

…but none of these really matter when you can’t find the right leads to talk to and close. Without that, you may not have the successful career you dream of.

And that’s why I’m here – to help you solve this issue and elevate your life insurance game.

In this post, you’ll discover the best life insurance lead generation strategies to help you get a consistent lead magnet — whether you’re a newbie or have been in the industry for a while. Let’s start learning the insurance lead generation ideas!

What Are Life Insurance Leads?

Life insurance leads are indispensable for any successful career as an agent. They are potential clients interested in purchasing your life insurance products.

Basically, there are three types of insurance leads:

- Cold leads: These are people who do not know what or who is being sold. Some don’t know that they need life insurance at all.

- Warm leads: These are leads where someone has engaged with them through your email list or made phone calls to them on their phone numbers. They are currently researching life coverage but are not ready yet.

- Hot leads: These prospects want to speak with financial advisors about their life insurance policy and buy coverage.

Knowing where your leads are in the sales funnel — cold, warm, or hot — can help you identify the right ways to easily convert them into future customer bases and loyal advocates for your brand.

Ways To Get Life Insurance Leads

There are three major ways to get life insurance leads.

1. Company Leads

These are leads that your insurance company has generated using internal data sources.

If you’re just getting started with life insurance, this is one of the easiest ways to get a steady flow of good leads. However, company leads come with its pros and cons. One of the pros is that it saves you the time and resources you’d need to acquire these lead quality.

On the flip side, getting these leads may mean lower commissions for each sale…

Another drawback is that they might not be exclusive, which means that other companies or coworkers might have contacted them.

2. Third-Party Life Insurance Leads

If your company does not provide any quality leads (or doesn’t provide any at all), then consider looking out for third-party companies generating such services for sale.

These companies require you to pay for the new leads upfront.

You can usually choose new clients that are super-specific to your company — filtering them via zip code, active life insurance policies, credit score, address, and demographics.

(However, some of these life insurance lead generation companies charge extra for this filtering.)

Additionally, you have two options when buying third-party life insurance leads:

- Shared leads: These are leads that other life insurance companies might have purchased.

- Exclusive leads: These are potential leads generated exclusively for you. Since they are fresh leads, they have higher chances of conversion.

A potential drawback of third-party leads is the risk. Since you pay upfront, you have to close the leads to not run at a loss.

3. Personal Leads

These are leads you can get from other sources depending on your skills, experiences, and commitment.

You can acquire these via social media or email list — we’ll discuss more about this life insurance lead generation way in the upcoming section.

Before You Start Generating Life Insurance Leads…

Before implementing any life insurance lead generation strategy, there are several crucial things that must be taken into consideration.

Understand Your Target Audience

Your target audience is simply those people who actually need what you have to offer.

This step is important during life insurance lead generation because it will mean attracting unqualified leads. If you fail to define your target audience – hardly any conversion rate will be achieved.

Crafting appropriate marketing strategies that resonate with this group can be easy once you understand your target audience.

So, how do you identify and understand your audience?

“Dig deep into your audience’s demographics and psychographics.”

Demographics include data such as:

- Age

- Income

- Marital status

- Occupation

For instance, your ideal customers might be aged 50+, having an annual income of $100,000+ or more, married or divorced, or white-collar employees.

Psychographics include factors such as:

- Interests and hobbies

- Values and beliefs

- Attitude and motivation

- Lifestyle habits

For instance, your ideal prospect may enjoy reading about personal finance, believe in taking care of her family, and prioritize saving and investing.

Identify The Best Channels For Life Insurance Lead Generation

Not all life insurance lead generation channels will work to attract your target audiences.

You want to identify what has worked for you in the past and what is likely to work. This is why knowing your target life insurance market is essential. With the demographics and psychographic data, you can determine which channels are effective to reach and connect with them.

Measure And Track Performance

The last thing you want to do is implement several strategies to determine if they work.

When it is just throwing everything against the wall, you are relying on luck and could even end up wasting your time as well as your resources.

Try finding key performance indicators (KPIs) that relate to the strategy being used.

After that, set a goal for that KPI or metric. For instance, if you’re trying generating leads using search engine optimization (SEO), your KPIs might look like this – number of organic leads generated.

(while the goal may be to get 500 organic leads by the third month.)

Now that you know who your target audience is, and which channels are best for promotion and tracking performance, all that remains is to jump into actual strategies aimed at attracting those leads.

Life Insurance Lead Generation Strategies

Now it’s time to really start closing more leads.

In this section, we’ll tell you about the proven, great way we’ve personally used to generate leads and maximize life insurance sales and return on investment.

Let’s dive in.

1. Find Prospects on LinkedIn

There are approximately 200 million LinkedIn Users in the United States — so the potential for finding qualified leads on the platform is huge.

But, to make the most of life insurance lead generation on LinkedIn, you have to:

- Optimize your profile

- Engage in relevant groups

- Show your expertise by sharing your knowledge

- Search for leads

- Send personalized messages

I don’t recommend just rushing and implementing each of these ways.

Instead, it’s far better to build a great profile and start using these techniques one by one. Maybe you find some to be more effective than the others — and if that’s the case, focus all your efforts on it.

2. Network With Other Professionals

Networking is a tried and tested way to get leads, and this applies to the life insurance industry, too.

Join online networking groups, or attend physical networking meetings and be deliberate about building solid relationships with your networks.

Make it more of a symbiotic relationship where both parties can benefit, which can mean:

- Send referrals their best way if it’s outside your industry or niche

- Share your knowledge with your network

- Provide value

Doing these makes you the go-to person if they are looking to send a referral.

“Referrals are the most effective marketing tactic according to B2B vendors (TrustRadius).”

3. Don’t Sleep On Referrals

As you’ve learned, referrals are gold.

But don’t just fold your hands and wait for them to come. Instead, it’s a lot better to create systems that will speed up the sales process. For instance, you can have a reward system for existing clients where they win something or get a cash gift when they refer someone to you.

You can also trade referrals with your networks, where you refer someone to them when they refer a lead back to you.

4. Create a Website And Blog

Having a website that is optimized for SEO means you can:

- Appear higher on search engines results

- Get seen by more prospects

- Drive traffic to your offer

Now, of course, there are Google ranking algorithms, updates, and everything. If you’re just starting with this, you don’t need to complicate it!

It can be as simple as creating a detailed website with a clear offer and call to action.

(That’s all it takes.)

In case you’re looking for some tips to get an edge, or you’re a nerd and like to dig deeper into such things, you can consider these tips..

- Include relevant keywords, meta tags, and descriptions

- Use appealing visuals such as images, videos, and infographics

- Create educational content that prospects are interested in and search for

- Optimize for mobile to offer a seamless experience

- Use internal links to guide users to other relevant content

- Include calls to action (CTAs) to make users take the desired action

…and of course, track metrics like traffic, engagement, and conversion rates to identify how you’re performing. Just make sure you don’t expect instant results.

(SEO is a long game, but it’s also one of the most cost-effective ones.)

5. Offer a Free Consultation

“If it’s for FREE, then it is for me!”

Cold and warm leads will make up the largest percentage of your leads. But, these prospects may need more information before they are ready to purchase. Offering a free consultation enables you to get your services in front of them, and handle whatever objection they may have.

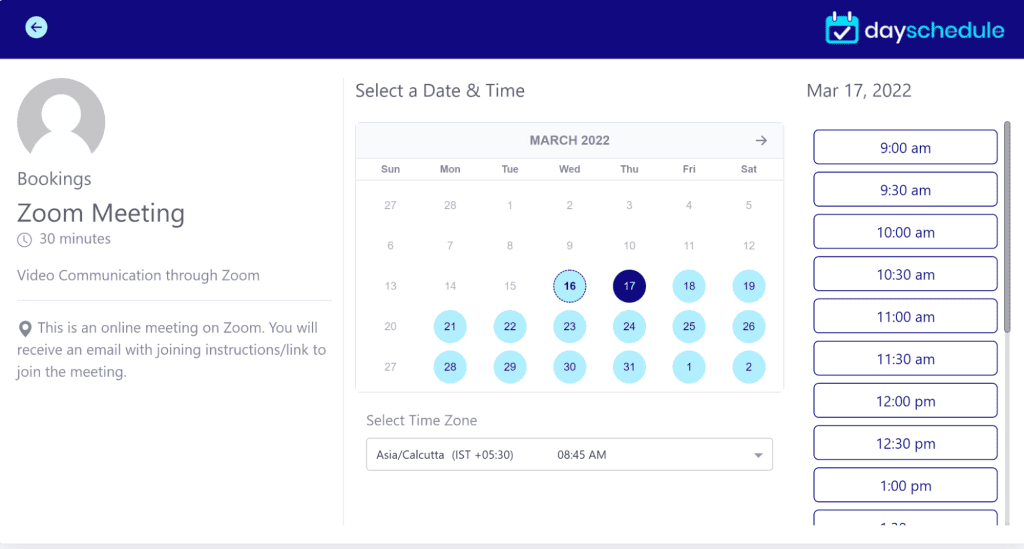

You can offer free consultations over the phone or a live video call.

To make things easy, create a page on your website (usually the Contact Us page) that encourages prospects to schedule a consultation and get their contact information.

I recommend using powerful tool such as Calendly, Google Calendar, or Zoom for scheduling.

6. Take Advantage of Listing Sites And Directories

An example of these sites includes Google My Business (GMB) and Yelp which are good for generating new real-time leads.

In case you haven’t, list your enterprise on these platforms now.

When prospects search for keywords such as “life insurance agencies near me,” your listing can come up on search if they are optimized for that and similar keywords.

(and to be honest, these terms are usually super-popular and offer a massive stream of traffic.)

Also, explore these listings to see negative reviews that prospects are leaving for competitors — then find a way to offer your services to these unsatisfied potential customers and a link back to your website.

7. Create Google Search Ads

This is a paid way to get your services to the top page of the search engine results page.

Google search ads have advanced targeting that enables you to appear in a search for keywords related to your services. Moreover, if somebody types in “life insurance plans”, and there’s no organic blog posts ranking for this keyword, then you can turn to paid ads to appear on top of the page.

Pay per click model is adapted by Google search ads.

This suggests that you will only be charged when someone clicks your ad and gets directed to your landing page. So, to maximize your ROI, your landing page must be a killer — here are a few tips for that.

To set up Google search ads, you’ll need technical skills.

If you don’t want to spend time figuring it out or you just prefer to outsource such things, I recommend hiring a Google search expert to set up your ads and optimize them.

8. Craft Educational Video Content

For those who have not been making videos yet, here are some reasons why they should start creating them.

- More than 2 in 3 people watches online videos

- Video accounts for 82.5% of all web traffic in 2023

- Viewers retain 95% of a message when watching a video (vs. 10% through text)

By creating educational video content, you increase your brand awareness, and resonate better with your target audience — boosting your chances of driving conversions.

9. Build an Email List To Nurture And Convert Prospects

Email marketing isn’t old school, and it certainly isn’t dead.

The average return on investment (ROI) for email is $36 for every $1 spent. This makes it one of the most profitable digital marketing channels.

Unlike social media platforms, where your account might get restricted for any reason, and you might lose your audience, with email marketing, you own your list and have full control. As you implement other life insurance lead generation strategies, one of your goals should be to send them back to your email list.

That’s by far one of the most effective (but also one of the hardest) ways to generate new customers.

For instance; you can use content marketing efforts can lead people to sign up for content upgrades and get added to your list.

Your email newsletter subscription call to action can encourage prospective clients to opt in for exclusive information.

When someone books an appointment, they get added to your list and may opt-in to receive marketing information. With an email list, you can nurture your audience and guide them with relevant content for conversion. You can also use your list to drive traffic to your blog and social media pages.

If you’re new to email list building, you should definitely check these best practices.

- Segment your email list to send more relevant information

- Ensure your emails are relevant with personal touch

- Write compelling subject lines as this is what gets your emails open

- Include appealing elements like images or videos

- Have a clear call to action for each email

- Test and optimize for maximum results

Just like with any other method, it’s crucial to analyze and measure performance with metrics like open rate, click-through rate, forwarding, and conversion.

That’s the only way to know whether you’re moving in the right direction!

Wrapping Up: What’s Your Favorite Life Insurance Lead Generation Strategy?

If you struggle with getting exclusive life insurance leads, you’ve come to the right place.

You’ve learned some of the best, battle-tested strategies we’ve personally used to find online insurance satisfied customers and close them quickly. Of course, I don’t suggest implementing everything right away.

Instead, it’s better to slowly build up these techniques.

You might even find that some strategies don’t work for you at all — while some do wonders. Just pick a few, implement them, and analyze them before you move on to the next ones.