This post may contain affiliate links. If you use these links to buy something we may earn a commission at no extra cost to you. Thank you for your support!

How many mbps do I need to work from home?

The internet speed you need for working from home depends on your specific work activities and online requirements, but generally, a speed of at least 100 Mbps is recommended for activities such as video calls and streaming, and fiber internet is the best option for fast and reliable connections.

These questions are probably taking place in your head: How much internet speed do I need? Why are my Zoom meetings and video games always laggy? How much Mbps connection is recommended, and what do all the different speeds mean? How much bandwidth is enough to support my online work and activities?

This article will answer all your questions. I break everything down into digestible, easy-to-understand parts. Let’s go!

The Beginning: Why Does Internet Speed Matter?

Over the past few years, the number of remote workers (and as such, internet users) has significantly increased worldwide, especially in the wake of the COVID-19 pandemic. As more people are transitioning to working from home, it’s becoming increasingly important to have a good internet speed that can support their work activities and online requirements.

From large file transfers to video conferencing, online gaming to video streaming, the internet has become an essential part of our daily work routine. Slow internet speed can not only affect the productivity of remote workers but can also impact the quality of their work. It’s frustrating to have latency issues during Zoom meetings or face network congestion while trying to upload a file. (I know, right?!)

Choosing the right internet plan and speed is crucial for anyone who works from home or is a digital nomad. The Federal Communications Commission recommends a minimum of 25 Mbps download speed and 3 Mbps upload speed for basic web browsing and video conferencing. However, for more demanding work activities such as video streaming or gaming, higher speeds and more bandwidth are needed.

In this article, we will discuss the different types of internet speeds, the minimum and recommended speeds for various online activities, the impact of the number of connected devices on internet speed, how to find great WIFI spots with great WIFI speed when you’re on the go, and ways to stay safe on the Internet when working from home.

Whether you’re working from a bustling city or in remote rural areas, there is good news. With options such as fiber internet, cable internet, and satellite internet, you can find the right internet package that meets your internet needs and supports your work activities.

What Is Internet Speed? – The Highway And The Restaurant

Internet speed refers to the rate at which data is transferred between your device and the Internet. It’s measured in megabits per second (Mbps), and it’s an essential factor to consider when choosing an internet plan for your home office or digital nomad lifestyle.

To understand internet speed, it’s helpful to think of it like a highway. The highway is the internet connection, and the number of lanes on the highway represents the speed. The more lanes you have, the faster the traffic can move.

Download speed refers to the rate at which data is transferred from the internet to your device. For example, when you’re streaming a movie on Netflix, you’re downloading the video content from the internet to your device. A higher download speed means you can download files faster and stream video content without buffering.

Upload speed refers to the rate at which data is transferred from your device to the internet. For example, when you’re uploading a large file to Dropbox or sending an email with an attachment, you’re uploading data from your device to the internet. A higher upload speed means you can upload files faster and conduct video conferences with high-quality video and audio.

To put it simply, download speed is like a waiter bringing food to your table, while upload speed is like the waiter taking your order to the kitchen. The faster the waiter can bring your food, the more efficiently you can enjoy your meal. And the faster the waiter can take your order to the kitchen, the faster you can receive your food.

In general, a good internet speed for working from home depends on your specific work activities and online requirements. It’s recommended to choose an internet plan with a minimum Internet speed of 25 Mbps for downloads and an upload speed of 3 Mbps, according to the Federal Communications Commission. However, for more demanding activities such as online gaming or video conferencing with high-quality video and audio, higher speeds may be needed.

To sum it up, internet speed is the rate at which data is transferred between your device and the internet. The higher the speed, the faster you can download files, stream video content, and conduct online activities.

How Many Mpbs Do I Need To Work From Home?

Image source: kristyting.com

Aha! The big question.

How much speed do I need? What connection speed works for me? What are fast speeds and what does each Mbps speed mean?

When it comes to choosing the right internet speed for working from home, it’s essential to consider your specific work activities and online requirements. Here’s a breakdown of what different internet speeds can do so you have a better idea of what you need.

It really depends very much on the type of work you do – be it graphic or web designing, coding, blogging and writing, editing and uploading YouTube videos, and more.

- 50 mbps: A 50 mbps plan is suitable for basic web browsing, video conferencing, and sending and receiving emails. With this speed, you can comfortably work from home and handle online activities such as social media, web browsing, and play online games without any lag. You can also stream standard definition (SD) video content on platforms like YouTube and Netflix without buffering.

- 100 mbps: A 100 mbps plan is recommended for more demanding work activities, such as video conferencing with high-quality video and audio, file transfers, and online gaming. With this speed, you can comfortably work from home with multiple family members or colleagues and support multiple devices, including laptops, smartphones, and tablets. You can also stream high-definition (HD) video content without buffering.

- 150 mbps: A 150 mbps plan is ideal for those who work from home and have multiple devices connected to the home network, such as smart home devices, gaming consoles, and streaming devices. With this speed, you can handle large file transfers, stream 4K video content without buffering, and enjoy online gaming without latency issues.

- 200 mbps: A 200 mbps plan is recommended for those who work from home and require faster download speeds and faster upload speeds. With this speed, you can easily handle any online activity such as video conferencing with high-quality video and audio, uploading and downloading large files, and streaming 4K video content without buffering.

- Faster speeds: For those who require faster internet speeds for work activities such as video editing, data analysis, and other demanding work activities, fiber internet plans offer the fastest internet speeds, ranging from 300 mbps to 1 Gbps. With these speeds, you can handle large data transfers and support multiple devices connected to the home network.

It’s important to note that internet speeds can also be affected by factors such as network congestion, data caps, and the type of internet connection. A wired connection such as the Ethernet cable connection is typically faster and more reliable than a wireless internet Wi-Fi connection. (Facts! And also from personal experience). Additionally, living in a remote area can limit your options for internet providers and may affect your internet speed.

It’s recommended to conduct an internet speed test to determine your current internet speed and identify any latency issues or network congestion. This can help you decide on the right internet speed for your work activities and ensure that you have a reliable internet connection for your work needs.

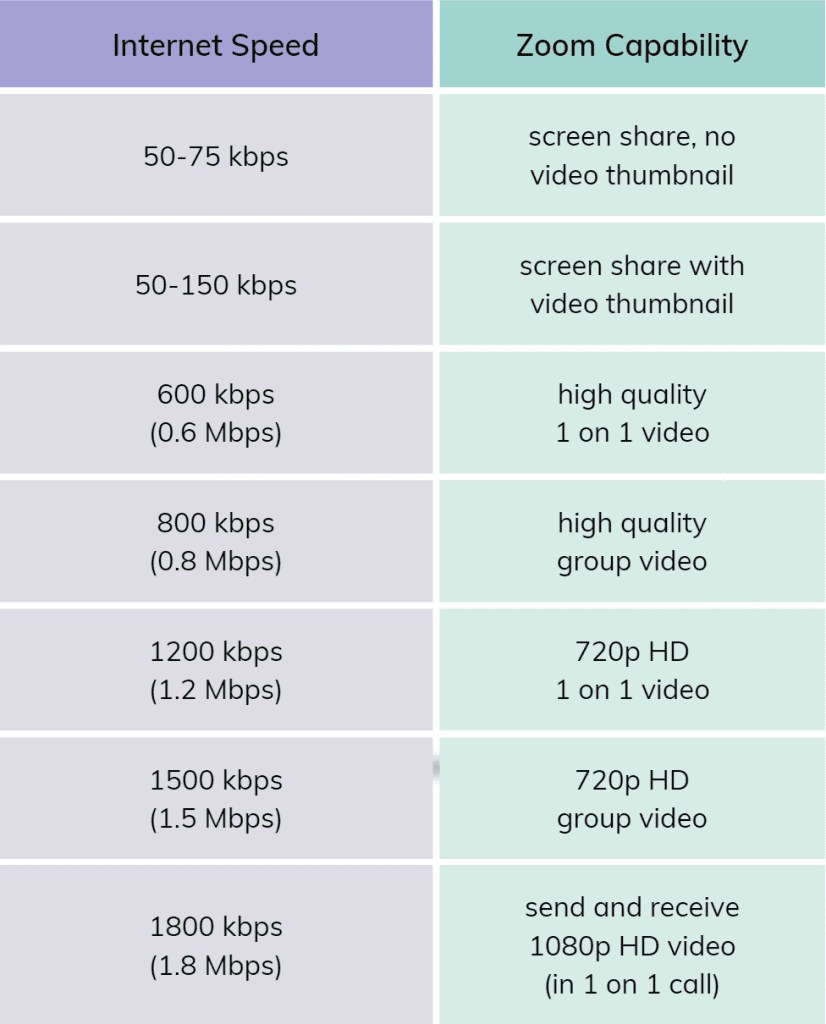

The table above gives you an idea of how Zoom performs at different speeds.

Do You Need Unlimited Data To Work From Home?

When working from home, you may wonder if you need an unlimited data plan for your internet connection. Unlimited data plans allow you to use as much data as you need without any restrictions. However, they can also be more expensive than plans with data caps.

If you’re using your internet connection primarily for work-related activities such as web browsing, email, and video conferencing, you may not need an unlimited data plan. Most internet plans offer sufficient data to support these types of activities, and you can easily track your data usage to ensure you don’t exceed your plan’s data cap.

However, if you’re a heavy internet user and require high amounts of data for work activities such as video streaming, online gaming, or downloading large files, you may benefit from an unlimited data plan. This way, you don’t have to worry about exceeding your data cap and incurring overage fees.

Taking Family Into Account

If you’re really working from home, it makes sense that you’re not necessarily alone in the house, correct? Your family members will be using the home internet to watch Netflix, browse their phones, or go online – all of which can be hampered by slow speeds. Taking each family member’s common activities into consideration, a fast connection for a family of 4 and above is a must. The amount of data has to be enough to allow everyone to have a good internet experience. In such cases, unlimited data may be required – unless you sign up for a package that gives you and your family enough internet download speed to sustain everyone’s usage.

Speed Throttling

It’s important to note that some internet providers may throttle your internet speed if you exceed your data cap or use too much data during peak hours. Data throttling means that your internet speed will be reduced, making it more difficult to conduct work activities or enjoy online content. In this case, an unlimited data plan may be the best option to ensure you have a reliable and fast internet connection.

Checking Your Internet Speed

To determine whether you need an unlimited data plan or not, you can use a speed test website to check your internet speed and track your data usage. Speed test websites like Speedtest.net can help you identify any issues with your internet speed, such as latency issues or network congestion. Additionally, some internet providers offer apps or online portals that allow you to track your data usage and monitor your internet speed.

Whether you need an unlimited data plan for working from home depends on your specific work activities and online requirements. If you’re a heavy internet user or require high amounts of data for work activities, an unlimited data plan may be the best option. However, if you primarily use your internet connection for basic work activities, a plan with a data cap may suffice. It’s also important to monitor your data usage and conduct regular internet speed tests to ensure you have a reliable and fast internet connection.

What Is The Best Type Of Internet To Work From Home With?

When it comes to choosing the best type of internet for working from home, there are three main options available: fiber internet, cable internet, and satellite internet. Each has its own advantages and disadvantages, so let’s break them down:

- Fiber Internet: Also the most popular home internet, fiber internet is the fastest type of internet available, with speeds ranging from 300 Mbps to 1 Gbps. Most households use fiber internet. It uses fiber-optic cables to transmit data, providing faster and more reliable internet connections than other types of internet. With fiber internet, you can handle demanding work activities such as video editing, data analysis, and large file transfers with ease. However, fiber internet may not be available in all areas, and it can be more expensive than other types of internet.

- Cable Internet: Cable internet uses coaxial cables to transmit data and provides high-speed internet connections, with speeds ranging from 50 Mbps to 1000 Mbps. It’s widely available and more affordable than fiber internet, making it a popular choice for many remote workers. However, cable internet connections can be affected by network congestion during peak hours, resulting in slower internet speeds.

- Satellite Internet: Satellite internet uses satellite technology to transmit data and provides internet connections to remote areas where other types of internet may not be available. It’s generally slower than fiber and cable internet, with speeds ranging from 12 Mbps to 100 Mbps. However, satellite internet can be affected by weather conditions, and it may not be suitable for activities such as online gaming or video conferencing due to latency issues.

In general, if fiber internet is available in your area, it’s the best option for working from home due to its fast and reliable internet connections. Cable internet is a suitable alternative and is widely available at affordable prices. Satellite internet should be considered as a last resort for those living in remote areas where other types of internet are not available.

What Are The Best Ways To Find Good WIFI Hotspots For People Working From Anywhere Or Are Digital Nomads?

We all know working from home doesn’t necessarily MEAN we’re at home, right? We can be at the airport, by the beach, or even be in our grandma’s kitchen in a small village! (That’s me!)

Fret not! As a remote worker or digital nomad, finding good WiFi hotspots is essential for staying connected and productive. Here are some ways to find WiFi hotspots:

- WiFi Finder Apps: There are several WiFi finder apps available that can help you find good WiFi hotspots. Examples include WiFi Map, Free WiFi Map, and Instabridge. These apps use your location to display a map of nearby WiFi hotspots, including cafes, libraries, and public places.

- Coworking Spaces: Coworking spaces are shared workspaces that provide high-speed internet connections, office amenities, and a community of like-minded individuals. Many coworking spaces offer daily or weekly passes, making them an excellent option for digital nomads. Examples include WeWork, Regus, and Spaces.

- Public Libraries: Public libraries are a great option for finding free WiFi hotspots, as they provide high-speed internet connections and a quiet workspace. Many libraries also offer printing and scanning services, making them an excellent option for remote workers who need access to office amenities.

- Coffee Shops and Restaurants: Coffee shops and restaurants are popular spots for remote workers and digital nomads, as they often provide free WiFi connections and a comfortable workspace. Examples include Starbucks, McDonald’s, and Dunkin Donuts.

- Mobile Hotspots: Mobile hotspots are portable devices that provide internet connections through a cellular network. They’re an excellent option for remote workers who need internet connections on-the-go. Examples include Verizon Jetpack, AT&T Mobile Hotspot, and T-Mobile Hotspot.

How Do You Improve Your Internet Speed?

I bet half of you scrolled down here immediately – because slow internet most likely makes us want to pull our hair out from frustration.

I’ve got you!

Here are some ways to improve internet speed:

- Troubleshoot Common Issues: Slow internet speeds can often be attributed to common issues such as network congestion, outdated hardware, or software issues. Try restarting your router or modem, clearing your browser cache and cookies, and disabling any unnecessary browser extensions. You can also try using a wired Ethernet cable for a faster connection instead of a wireless connection to improve your internet speed.

- Upgrade Your Hardware: Upgrading your hardware can improve your internet speed, especially if you’re using outdated equipment. Consider upgrading your router, modem, or network adapter to the latest models that support faster internet speeds. You can also try using a WiFi extender to boost your WiFi signal and improve your internet speed. This isn’t a ‘right now’ type of solution, but if you make the effort and get your hardware upgraded, you’ll be soooo thankful in the future when you no longer experience laggy internet!

- Change Your Internet Service Provider: If you’re experiencing slow internet speeds despite trying all the troubleshooting steps and upgrading your hardware, it may be time to consider changing your internet provider. Research different internet providers in your area and compare their plans, prices, and customer reviews. Some internet providers may offer faster internet speeds or more reliable connections than others. If you’d prefer to stay with the same provider, simply call them up and ask if there are any better packages with better internet speed that you can upgrade to.

- Use a VPN: A VPN (Virtual Private Network) can improve your internet speed by reducing latency issues and network congestion. VPNs encrypt your internet connection and reroute your traffic through a secure server, which can provide a faster and more reliable internet connection. However, keep in mind that VPNs can also slow down your internet speed if the server you’re connecting to is located far away or if the VPN provider has bandwidth limitations.

- Optimize Your Internet Settings: You can optimize your internet settings to improve your internet speed by adjusting your DNS settings, optimizing your browser settings, and disabling any unnecessary applications or background processes that may be consuming bandwidth. You can also try changing your WiFi channel to reduce interference from other WiFi signals in your area.

How Do You Stay Safe When Working From Home On The Internet?

Image from Telethon

We’ve all received that scary phishing email, or clicked on a link from a Facebook comment or on a random website without thinking. Don’t panic yet! If you have the steps below done, you’re pretty much safe – though, of course, common sense still needs to prevail. Don’t simply open forwarded links from people on WhatsApp. Don’t click on links in emails you don’t know about – especially those claiming to be from banks. Don’t believe that you’re a lottery-ticket winner. You get the idea.

Here are some ways to stay safe on the internet when working from home:

- Use Antivirus Software: Antivirus software can protect your device from malware and other cyber threats. Make sure to keep your antivirus software up-to-date and scan your device regularly.

- Use Strong Passwords: Use strong passwords for your online accounts and change them frequently. Avoid using the same password for multiple accounts and enable two-factor authentication whenever possible.

- Avoid Public Wi-Fi: Avoid using public Wi-Fi networks for work-related activities, as they may not be secure. Instead, use a VPN or a personal hotspot to ensure a secure and encrypted connection.

- Use Email Protection Features: Use email protection features such as spam filters and email encryption to protect your emails from phishing attacks and other cyber threats. Avoid clicking on suspicious links or downloading attachments from unknown senders.

- Use Secure Cloud Storage: Use secure cloud storage services such as Dropbox or Google Drive to store your work-related files and data. Make sure to enable two-factor authentication and set strong passwords for your cloud storage accounts.

- Regularly Update Your Software: Regularly update your operating system, web browser, and other software to ensure they have the latest security patches and updates.

- Use Firewall Protection: Use a firewall to protect your device from unauthorized access and other cyber threats. Make sure to configure your firewall settings properly and enable it on your device.

- Be Cautious of Social Engineering Attacks: Be cautious of social engineering attacks such as phishing, baiting, and pretexting. Avoid sharing personal or sensitive information with unknown individuals or companies, and always verify the authenticity of requests before providing any information.

- Back Up Your Data: Regularly back up your data to an external hard drive or cloud storage to ensure you don’t lose important work-related files in case of a cyber attack or device failure.

In summary, staying safe on the internet when working from home requires a combination of good cybersecurity practices and using secure software and services. By following these tips, you can protect your devices and data from cyber threats and enjoy a secure and productive remote work experience.

Conclusion: How Many Mpbs Do I Need To Work From Home?

In conclusion, the internet speed you need to work from home depends on your specific work activities and online requirements. Basic activities such as web browsing and email may only require 25 Mbps, while video conferencing and streaming may require 100 Mbps or higher.

To determine the internet speed you need for your work activities, consider the number of devices you use, the type of work you do, and the size of files you need to transfer. Also, consider whether you live in a rural area or an urban area, as this can affect the availability and speed of internet connections.

If you’re a remote worker or digital nomad who needs a fast and reliable internet connection, fiber internet is the best option. However, if fiber internet is not available in your area, cable internet is a suitable alternative.

In general, it’s better to choose a higher speed internet plan than the minimum recommended by the Federal Communications Commission (FCC) to ensure you have enough bandwidth for your work activities. It’s also important to monitor your internet speed regularly and troubleshoot any issues to ensure you have a reliable and fast internet connection.

In summary, the internet speed you need to work from home depends on your specific work activities and online requirements. Consider your options carefully, choose the best type of internet available in your area, and enjoy a fast and reliable internet connection for your remote work experience! I hope this guide was helpful and answered your questions!